2021 – The year the corporate world adopted Web3, Crypto and the Metaverse

Newsletter 4 - January 1, 2022

I know this is only my fourth Newsletter and so it feels a bit ridiculous to be doing a year in review edition. That said, it’s the end of the year and I can’t resist. But don’t worry, I know you already have a ton of these types of newsletters in your inbox, so I’ll try to give you a different perspective.

I know a huge number of people who got into Crypto and found their way to the Metaverse this year through NFTs or just out of FOMO as they watched the price of BTC, ETH, DOGE, DOT, SOL, or any one of the many other tokens that have made headlines this year. But despite all the money that individuals have poured into the category, it’s still tiny as a proportion of total individual investments (approximately $2.5 trillion for Crypto, $9 trillion for gold, $49 trillion for the US stock market, $325 trillion for the global real estate market).

So NO … 2021 will not be remembered as the year that these technologies went mainstream. But it might well be remembered as the year that their mainstream adoption became inevitable. Proof of this inevitability is apparent simply by looking at the number of brands and businesses that have jumped in as they try to get ahead of the curve.

With that in mind, here is my list TOP FIVE list from 2021:

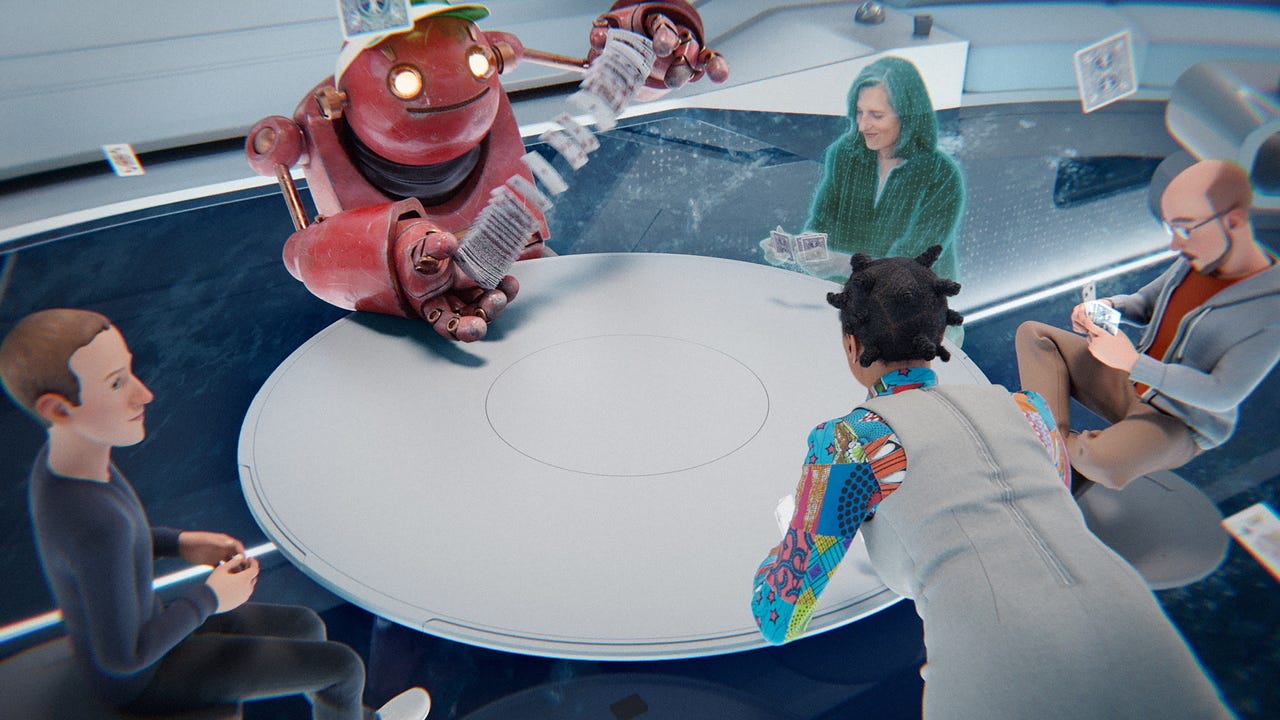

Facebook changes its name to Meta.

Whatever you think about the rationale and motivation behind the change, a few things are undeniable. Firstly, that brands of this size don’t take decisions like this lightly. And second, that this sends a very clear signal of intent and belief about where the future lies – not only for their business but for the technology world as a whole.

Meta believes that repositioning themselves as a Metaverse / Web3 business can futureproof their business - and when they spoke the world was listening as it triggered explosive interest and investment across all aspects of the category.

Nike buys RTFKT and becomes the non-tech brand to go all-in on Metaverse

I will mention NFTs and brands a bit more later in this list, so why call out Nike specifically. The answer to that is easy – unlike many other brands who are dipping their toes in the water with NFT purchases and drops, Nike bought a 2-year-old company with only a handful of employees and made it a portfolio brand along with a very select few including Air Jordan, Converse, and Cole Haan.

The purchase followed the launch of AR / Metaverse experiments with SNAP and the launch of the NikeLand within the Roblox Metaverse. In short, Nike has been building a comprehensive strategy around digital property and ownership, and with the purchase of the RTFKT, they secured their position as pioneers in the space.

Venture Capitalists and seasoned founders rushed to the category, invested and then invested more

In total, Crypto companies raised over $31 billion from Venture Capital in 2021. It’s still only a small portion of all VC monies invested, but for some firms like Andreessen Horowitz and Paradigm, it represents a significant shift in focus as they raised $2.2 billion and $2.5 billion for crypto-specific funds respectively.

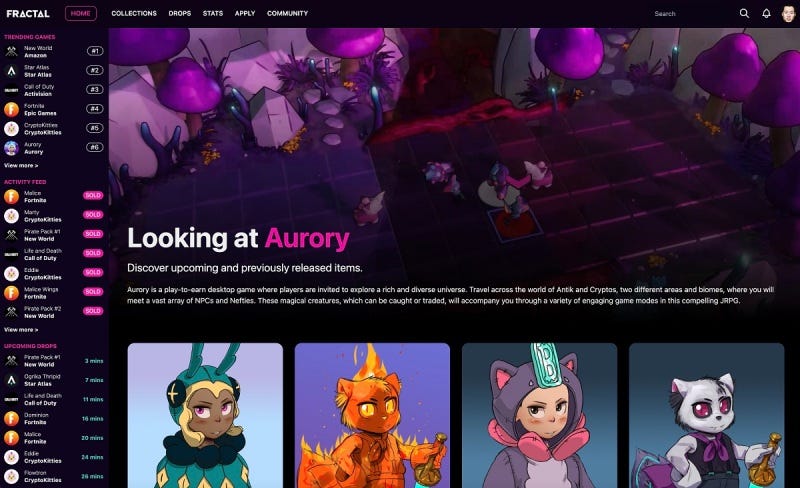

The importance of this move is further noted by the rush of established entrepreneurs and successful founders into the space. The most recent announcement coming from Twitch co-founder Justin Kan who launched the NFT Gaming Marketplace Fractal earlier today.

Brands ape’d into NFTs all over the place

It’s worth noting that Beeple’s $69m NFT sale was the catalyst that started the explosive growth in the NFT category. Growth that saw the category increase in value from less than $50m to roughly $10.5b (an increase of over 20,000%). And all this despite there being only a million + NFT holders globally.

But that didn’t stop brands from looking for ways to participate in meaningful ways.

Adidas bought a Bored Ape Yacht Club (BAYC) NFT and then launched their NFT in partnership with BAYC giving holders access to exclusive merchandise and other benefits

Pepsi drops free NFT that immediately surges in value in value and aftermarket sales

The NBA launched Top Shot as a vision into the future of trading cards

and many more

El Salvador becomes the first country to adopt a digital token as a national currency

While not a corporation, I still feel that this deserves and honorable mention as it represents a nation putting their faith into a store of value beyond their control.

Yes, that’s been done before by countries adopting the US dollar as an accepted currency, but this is different. In this case, there is no central bank, there is no assurance that volatility will be managed, there are no authority figures that you can rely on to manage the asset. More importantly it lays a foundation for large shifts in corporate finance and governance structures.

And while El Salvador is small, the world will be watching this experiment and I expect the impact will be felt for years.

It’s true that at the same time as these brands (and many others) were jumping into the space, individuals were buying Crypto and driving valuations up by roughly 400% in 2021 (the total Crypto marketcap went from ~$600b to ~$2.5t), but the truth is that despite all the news, the average person still has no crypto investments, own no NFTs, have explored Virtual Reality or any other form of the Metaverse.

Like teenage sex, this is still something where everyone is talking about it, but not everyone is doing it. And that is where my predictions for 2022 come in.

If 2021 was the year that corporates adopted Crypto, 2022 will be the year it goes mainstream with consumers.

To rapidly accelerate adoption, more people to feel that the category is safe, it will need to be easier for people to use the products, new use cases will need to be developed, and people will need to see how the purpose of the products fit into their lives and careers.

That’s where my top predictions come in and reflect how I believe the space will continue to grow and onboard new users in 2022:

The US will announce formal Crypto regulation and it will be very bullish for the adoption

The value and the growth of the category will mandate that the US think carefully about regulation. In the end, I believe they will er on the side of growth and look to adopt regulations that encourage development and adoption of the technologies as they will not want this wave of entrepreneurialism to move abroad.

Yes, it will likely mean tighter restrictions on the trading platform with consumers seeing reductions in the leverage they can take when trading/investing, but if that regulation is thought about responsibly this isn’t necessarily a bad thing.

The bigger impact though is that we will see a greater volume of investment-grade assets and traditional finance houses creating on-ramps for consumer participation. Overall, it will mean a lot more investment into the space.

MetaMask (or another leading Crypto Wallet) will partner with either STRIPE, Adyen, PayPal, or potentially even VISA, MasterCard, or AMEX to enable point of sale purchase capabilities

Today, there are about 100 million Crypto Wallet users (Statista reports the number as 70 million as of early November, but based on the number of NFT holders globally I think they are under-reporting). The challenge is that onboarding yourself to a wallet isn’t easy enough yet.

To get your wallet set-up, you have to download the wallet, install it as a browser plug-ins (or as an mobile app), manage your own security by remembering a 12- or 24-word security passphrase, add the chains that you want to use if for example any of your desired tokens are not ERC20 (ie Avalanche or Solana or another alternative Layer 1). All that before finally making a transactions – which requires in some cases can require the wallet owner to connect to relevant sites, enter 64-character hex strings, and/or approve the transaction and the associated fees / gas.

It’s still a bit too complicated for most people (remember how long it took for the US to adopt Chip and Pin credit cards).

But despite this, Wallets are and will be a major on-ramp for people who want to use any Crypto products for investment purposes or to transact and buy in the Metaverse. VISA and MasterCard know this and are already investing heavily in the space, but I expect we will see large partnership and/or acquisition announcements that accelerate consumer onboarding and adoption.

DeFi (Decentralized Finance) will go mainstream as more people chase higher yeilds to keep up with inflation

Today the total locked value in DeFi is just under $100 billion. This is money invested in interest or yield-bearing products outside of banking and traditional investment categories. By the end of 2022, I would predict this will be over $2 trillion.

That’s a 20x increase and a big bet on my part. Some dependencies need to happen first for this to occur. But I believe the pieces are in place to make it happen.

As mentioned above, regulation of the category will increase the volume of investible assets, and more importantly will increase the number of people who see the space as one that is worthy of their investment.

The launch of ETH2, along with the growth of lower transaction fee blockchains will bring down transaction costs to a point where small investments are increasingly attractive

Crypto wallets will become easier to use reducing the barrier for money people to enter the space

Brands like Lido, Curve, Compound, and many others will lead the way.

NFT will mature beyond art to become true providers of service and utility (and in so doing will further accelerate adoption and usage of Crypto and Metaverse)

Today when people think of NFT’s they mostly think of art or pixelated Punks. But this will change.

Last week OpenDAO launched their new Crypto Token $SOS and distributed it via AirDrop to all Crypto wallets that had previously engaged with the OpenSea NFT platform. The token exploded in value, yielding some of the early and active NFT traders with tokens valued in the 5 figures (although the value of the average wallets AirDrop was only $125).

While the token made headlines, I believe that what will emerge as a result of these strategic AirDrops are new CRM and Media strategies designed to target communities with absolute precision.

Imagine for example that a luxury car brand decides to make their Car Titles NFTs (which will happen at some point for reasons that I will explain in the future - although doubtfully next year). Now imagine that an Airline promoting Business Class travel wanted to talk to luxury buyers. Why not airdrop tokens with promotional benefits and messages directly to the relevant Crypto Wallet?

This type of targeting will start in 2022. But I will write more about this in a future news update.

Another interesting development in the land of NFTs comes from GaryVee whose VeeFriends NFT has soared in value since its launch earlier this year. But rather than VeeFriends, it’s his latest NFT project Flyfish Club that I want to highlight here.

Flyfish Club is the NFT for his new restaurant. What’s interesting is that reservations for the restaurant will only be available to holders of the NFT, and with only 352 NFTs in the world, that will make this a very exclusive restaurant to get into. Before you think that no restaurant can sustain itself on only 352 customers, know the NFT will be loanable, this means you can borrow it from a friend and get yourself a booking – if you know someone who has one of the NFTs. But No NFT, no Reservation.

I believe that this type of business model - where NFTs unlock real-world value - is a model that is here to stay and we will see a lot of innovation in this area.

New VR and AR hardware launches will win the PR battle for headlines, but Sandbox and Decentraland will be the real winners of the Metaverse race as more people and brands establish themselves as owners of Digital Assets

It’s long been rumoured that Apple would soon be releasing their AR glasses. Maybe it will finally happen in 2022. Meta has already announced that they will be launching a high-end VR system with capabilities that go beyond the current Oculus Quest 2. And we will likely also see new launches from other players like SNAP and the Ray-Ban / Meta partnership.

But while these 3D projects will make headlines, the real growth will come out of the 2D space as people and brand race to establish themselves as property owners on platforms like Sandbox. We will see property ownership in the Metaverse grow from less than 100k current owners to over 1.5m people.

More interestingly we will see cross-over between real world and Metaverse products become the norm with many traditional businesses establishing Metaverse teams.

An example of this from a product POV will be combining an NFT pair of shoes with a real pair of shoes so that your Avatar can wear the same things in the Metaverse that you wear IRL.

An example of how businesses will adapt will be seen through events companies having dedicated Metaverse teams, and even a few architecture firms launching high-end Metaverse projects.

DAOs will present themselves as a potential blueprint for the future of work by enabiling a community powered and purpose driven “contribute-to-earn” model for employment and earnings

DAOs (or decentralized autonomous organizations) are emerging as a new corporate governance structure that is built around community. They are starting to look a bit like a potential next-generation competitor of the LLC. Built around blockchains, the concept is still taking shape, but we are already seeing amazing growth (membership grew from 10k to 1.6m in 2021, and treasuries grew from 400m to over 12b) and amazing projects such as

Constitution DAO raised nearly $50m from members in an attempt to buy one of the copies of the US Constitution.

Krause House DAO is currently building their members and funds with the ambition to buy an NBA team

These two projects represent the next generation of Crowd Funding and Activist Investing respectively, and I believe that next year we will see many others that build on the models they have started. For example, I wouldn’t be surprised to see an Activist Investor DAO that looks to buy stock in companies with the mission of getting board seats and influencing their direction – say around sustainability issues. Sharp and defined missions built around community objectives and desires will become the norm.

So those are my big bets for 2022, though I am sure we will also see lots progression around other aspects Metaverse, Crypto, and Web3 through services like Sign in with ETH and increased adoption of ENS addresses making the space easier for mass market engagement.

But what excites me about 2022 is that with a space that is developing as quickly as this one there are also bound to be a lot of surprises.

Happy New Year, and I look forward to sharing my views and hearing yours next year as we navigate this fast-evolving space together.

Thank you for pulling together so much relevant information - These days we are all trying to drink from multiple fire hoses of information. Your overviews are extremely valuable in knowing what to look for and how to direct our attention. My takeaway is that we are seeing a global revolution in progress that will in a few short years transform business, governments and our daily lives in ways that almost no one has even begun to grasp. Thanks for helping us keep up.