A contrarian view on crypto values from a long-time blockchain advocate

Why a business friendly crypto environment does not necessarily equate to continuously rising prices

Welcome back to the Brand Next newsletter where we explore how emerging technologies are changing marketing and human behaviour by spotlighting the people, technologies, and use cases that put strategy into action and drive valuable business results.

If you enjoy this article please share and subscribe.

You can also subscribe to the Brand Next Podcast on Spotify, Apple Podcasts, or YouTube.

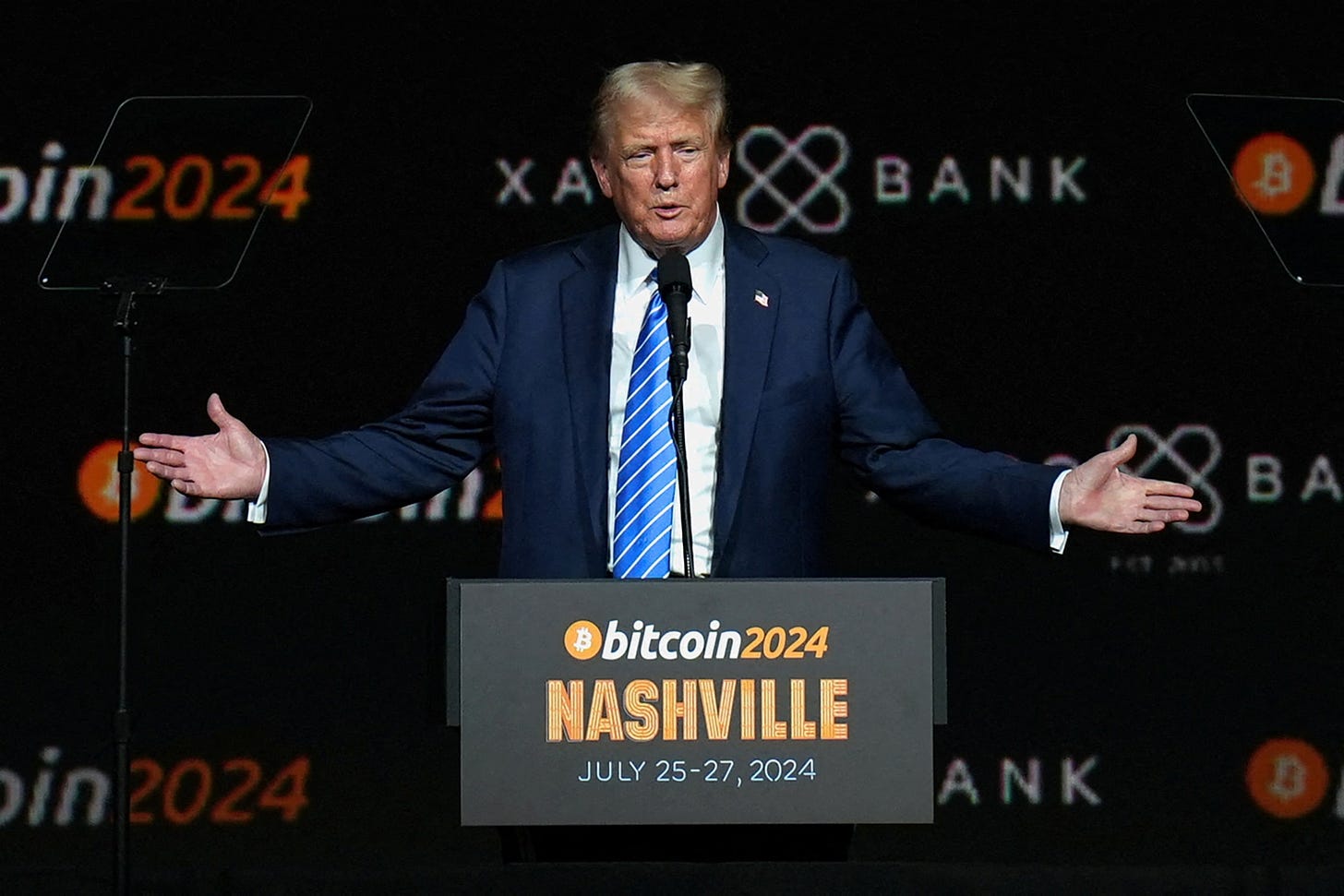

In the wake of Trump’s presidential victory, crypto investors have been riding high as Bitcoin makes new all-time highs, and the crypto market is buzzing with optimism. Many people are predicting that Trump will bring a crypto-friendly administration that will finally usher in clear regulations and pave the way for broader blockchain adoption.

But here's an unpopular opinion for everyone:

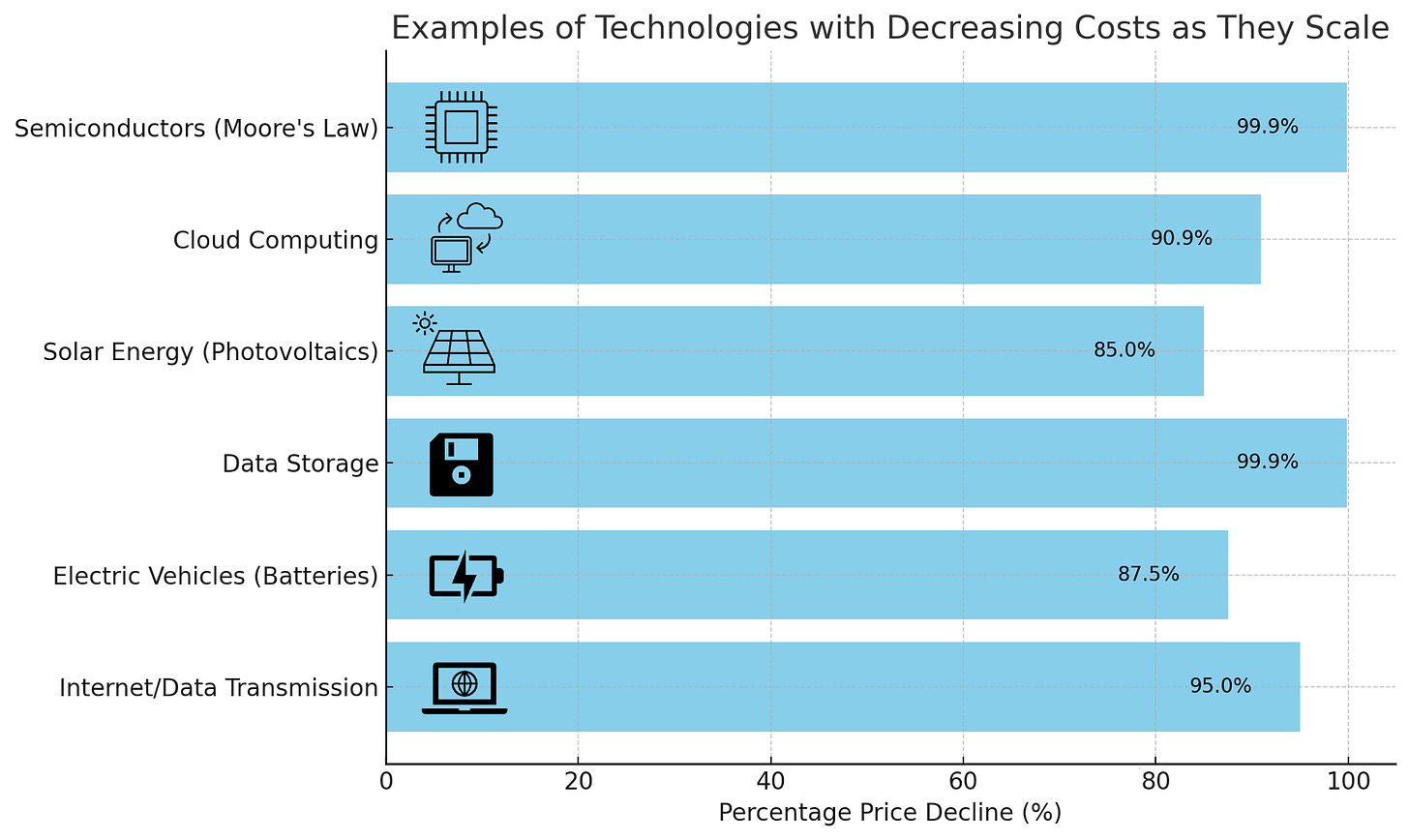

While clear regulation will be great for blockchain use cases adoption and token integration into business processes, it does not necessarily mean token prices will go up with demand and usage. In fact, history and economics would suggest that the opposite might actually happen. Technologies that scale in usage typically experience a decline in price, and so as tokens are adopted by people and business to provide real services, they will likely prove no exception and we could see price declines.

Here’s why.

The Trump Administration and a Bullish Crypto Market

The market's optimism stems from a perception that the Trump administration will adopt a pro-business stance toward crypt, and remove Gary Gensler from the SEC allowing for regulatory clarity and a favorable environment for blockchain innovation.

This narrative, along with Trumps comments that the US Government will never sell it’s Bitcoin holdings, and speculation that he may actually instate a strategic Bitcoin reserve (similar to the US Government Gold holdings) has brought institutional investors, and more retail investors (via ETFs) into the fold. Since the launch of the Bitcoin ETFs earlier this year, asset managers have increasingly viewed Bitcoin as a store of value, akin to digital gold, and any move by the US government to establish a strategic reserve would further validate this belief.

This belief has fueled the post-election crypto market price increases as people race to get back in ahead of larger institutional and nation state buyers. And while this crypto bull run has been uniformly good for token prices, it does not mean that all tokens will benefit equally in the long run?

Blockchain Adoption ≠ Token Price Increases

The reality is that blockchain technology’s success doesn't inherently translate to token price appreciation. History has repeatedly shown that as technologies scale in access, adoption, and usage, prices tend to decrease, not increase.

Take cloud computing as an example. When cloud services like AWS, Microsoft Azure, and Google Cloud first launched, they were expensive. However, as adoption increased and competition grew, the cost of storing 1 GB of data dropped from $0.11/month in 2010 to less than $0.01/month today. Businesses benefited from the lower costs, and the profitability for the hosting services was driven by volume, not scarcity or speculation. We are already seeing the same occur with the usage of AI models.

Similarly, in renewable energy, the cost of solar photovoltaic modules has plummeted by over 85% since 2010, thanks to increased manufacturing scale and technological improvements. While adoption skyrocketed, prices fell to make the technology accessible for widespread use.

For blockchain to become integral to business operations, the same trend is likely to play out. Businesses after all look for price stability, predictability of budgeting, and economies of scale as they plan for technology and operational investments. A volatile or expensive token creates uncertainty, deterring adoption. So as tokens position themselves to win with businesses through utility rather than just winning with investors through speculation, the economics of token pricing will change. And so in cases where tokens aim to grow demand through utility rather than simply investment, prices are likely to decline as they look to facilitate broader integration.

Blockchain in Business: Where is Adoption Most Likely

Blockchain is transforming the way businesses operate, particularly in areas where transparency, security, and efficiency are paramount. While its applications are vast, certain sectors are uniquely positioned to benefit from blockchain adoption. Here's where we’re likely to see the most impact and how adoption might unfold:

Financial Transactions and Payments

The financial industry remains the most immediate and significant use case for blockchain. The technology's ability to provide secure, fast, and transparent transactions is unparalleled and is already being adopted for Cross-Border Payment and settlements, as well as for Smart Contract (self-executing contracts) to facilitate automated, secure, and transparent agreements as related to escrow services, loan disbursements, or insurance claims.

Identity Data Management

Blockchain provides a secure way to manage identity data, addressing growing concerns around privacy and data breaches. Tokenized Self-Sovereign Identity (SSI) enables individuals and businesses to own and control their identity data. For example, companies like Nuggets are using blockchain technologies to allow businesses to verify a customer's credentials (e.g., age, employment, or certifications) without exposing unnecessary details. This technology provides value in identifying people in digital environments while still complying with regulations such as GDPR and CCPA.

The advent of AI Agents that can replicate interactions online will likely increase the need for Proof of Identity as we look to secure ourselves against fraud, and blockchain based identity is a likely high growth solution for this issue.

Privacy-Enhanced Collaboration

Blockchain’s cryptographic capabilities make it ideal for industries where privacy and secure data sharing are critical such as healthcare, where tokens could allow providers to securely share patient records while maintaining privacy, streamlining operations and reducing costs.

Marketing and Consumer Engagement

Blockchain has the potential to revolutionize marketing by enhancing transparency and fostering direct relationships between brands and consumers. Starbucks and Nike are prime examples of brands who tried this, and while their initial efforts failed to deliver on revenue expectations, the model was based on sales rather loyalty.

Additionally, Blockchain can help to solve one of the Marketing Industries most persistent problems: Ad Fraud. It could help ensure transparency in digital ad spending by verifying impressions, clicks, and conversions.

Enterprise Resource Planning (ERP)

Blockchain can integrate with ERP systems to improve business efficiency by enabling automated supply chain tracking, leveraging smart contracts to reduce paperwork, and provide real-time updates across departments. All of which would be capture in immutable records making it easier for businesses to conduct audits and meet regulatory requirements.

In each of the above cases, for blockchain adoption to succeed, businesses will need to prioritize practicality over hype, and will need to be clear on costs and scalability without introducing financial risk and uncertainty.

Industry-Specific Solutions: Blockchain applications must solve real business problems, such as reducing costs, increasing transparency, or improving security.

Collaborative Ecosystems: Adoption will thrive in ecosystems where multiple stakeholders—governments, enterprises, and consumers—are aligned on shared goals.

Regulatory Clarity: Clear guidelines will encourage businesses to invest in blockchain without fear of legal repercussions.

Cost Efficiency: For blockchain to integrate into business operations, token prices must remain stable or decrease, enabling scalability without introducing financial risks.

Bitcoin as an Outlier: Digital Gold

Bitcoin stands apart in this narrative. With its fixed supply of 21 million coins, Bitcoin is increasingly being positioned as a modern proxy for gold—a store of value rather than a utility token.

Yes, there are plenty of projects trying to build utility on top of Bitcoin, but in most cases, there are alternative blockchain solutions that are faster and cheaper. So to most, it remains an investment asset more than a utility.

Additionally, institutional investors, from hedge funds to pension managers, have increasingly adopted Bitcoin as a hedge against inflation and macroeconomic uncertainty. This was accelerated earlier this year with the launch of multiple Spot Bitcoin ETFs.

And while other tokens have had ETFs launched, for example ETH, they have not garnered the favor that BTC managed because the "digital gold" narrative is not easily replicable. Just as there is only one gold, there is probably only one Bitcoin. Other tokens attempting to position themselves as "investment-grade" assets face the potential of an overcrowded market with diminishing returns.

The Fragility of Collectible Tokens

The situation is even bleaker for tokens that present themselves as speculative collectibles. Whether it's NFTs or tokens tied to niche use cases, their long-term viability is questionable.

Consider the historical failure of collectible markets like Beanie Babies or speculative trading cards during crashes. When oversaturation and speculative bubbles burst, values plummet. Similarly, while NFTs enjoyed massive hype in 2021, many projects have seen significant devaluation as interest wanes.

The Unpopular Truth

The crypto world may dream of an environment where token prices endlessly skyrocket, but history and economics suggest otherwise. Blockchain technologies offer huge promise and potential as adoption of these technologies could be good for businesses and the broader economy, but it doesn’t guarantee price appreciation for the tokens underpinning these systems.

Instead, friendly crypto regulations could fuel business adoption of tokenization and prioritize blockchains that offer stability, scalability, and cost-efficiency over speculative pricing.

What this mean for investors / speculators

Utility Tokens: If they behave as other technologies have, prices would be likely to decrease as adoption increases. There isn’t a supply and demand function here with limited token availability. Instead businesses are likely to prioritize, value, scalability and predictability, over speculative gains.

Identity Data and Blockchain: This is a promising area for brands, but its success hinges on cost-efficiency and practical integration in a compliant manner.

Bitcoin: As a unique digital asset, Bitcoin may continue to grow in value. Who knows? But where it previously led market direction, it is likely that the investment market and the utility market will decouple.

What this means for business

Transparent legislation opens to the door to scaling opportunities in blockchain and new use cases that extend beyond finance and settlement. Yes it’s time to build. This could include loyalty and engagement programs, new commerce models, and updated approaches to compliant and private collaboration.

What this means for blockchain brands

With transparent regulation, the hard work begins. The first marketing efforts were with investors who wanted to see token pricing go up. Future marketing efforts will need to balance the hope and expectations of those existing investors and stakeholders with the emerging needs of enterprise users looking for cost efficiency and risk management as they make technology decisions.

The truth is that no one knows what the price of every token will be in the future. So while future of crypto once again looks bright, it doesn’t necessarily mean that it will fulfill people’s hope that the “number go up.”

This article is not financial advice. Nothing written should be seen as an endorsement or recommendation of any investment strategies or financial advice.

If you enjoy this and want to get more, please subscribe

If you already subscribe and want to do more to help grow our readership, please share the article with your friends. One share from you makes a world of difference to me.

Subscribe to the Podcast on Spotify, Apple Podcasts, or even on YouTube

Follow me on X at @justinkpeyton

Follow me on LinkedIn