Hello again, and thanks for joining me at Becoming Metaversal. In each issue I aim to update you about what’s been happening in Web3 and the Metaverse. My ambition is to help you learn, grow and build in the space. If you are reading this and haven’t subscribed yet, you can join the growing group on people by subscribing here. 🚀

It’s been 3 weeks since my last newsletter, so there is lots to catch up on. Here are a few of the highlights of what’s been happening in the world of Web3, NFTs, and the Metaverse. In all honesty, this feels a bit shallow when in light of all that is happening in Ukraine, but at the same time, so much has been written about the role Crypto is playing that it would be amiss not mention it - so here we go:

The Ukrainian government published Crypto Wallet addresses where people could donate to them. As of March 10th, they had received nearly $100m in Crypto donations. (Story from Coindesk)

These efforts were bolstered by Alona Shevchenko, PleaserDAO, and Pussy Riot who together set up UkraineDAO and sold an NFT of the Ukrainian flag for 2,250 ETH / $6.75m. (Full story from Decrypt)

Where there are good intentions, there is also fraud with multiple instances of fake donation addresses being created to solicit funds that will not end up with Ukraine. (Full story from the WSJ)

At an event called Plan ₿, the city of Lugano in Switzerland legalized Bitcoin and Tether as currency. (Story from Coindesk)

Joe Biden signed an executive order focused on Crypto. Details were light but overall it is being seen as encouraging for the space and an indicator that thoughtful regulation could be ahead. (Story from CBS)

Dubai establishes the Dubai Virtual Asset Regulation Law as it aims to take the lead in this space. (Story from Reuters)

I’ve written a lot about the need for better onramps into Crypto. On that front, Stripe just announced that they will be supporting crypto payment along with an onramp from FIAT to crypto. In my view, this is likely to have a significant impact in the medium to long term (Story from TechCrunch)

At the beginning of the year I made a few forecasts, one of which was that this year would be a year of consolidation and mergers in the Crypto and Web3 space. It appearS that I was correct in that one as two big mergers were announced this past week:

Pokemon Go creator Niantic is buying the AR business 8th wall (Story from TechCrunch)

And Yuga Labs, the creators of Bored Ape Yacht Club are acquiring the makers of NFT OG collections CryptoPunks and Meebits (Story from The Verge)

Puma dove into Web3 with a new puma.eth ENS, and a collection of NFTs including a Cool Cat, a Gutter Cat, and a Lazy Lion. (Story from Rarity Sniper)

Gucci dives deeper into the Metaverse with their latest NFTs launch. More on this later as well, but here is a quick summary. (Story from Vogue business)

After raising $70m in NFT sales, the Pixelmon reveal was an absolute disaster. The art was actually so bad, that Kevin (one of the characters) has gone on to become a meme and is now being viewed by some as a historically significant NFT, and so commanding very high prices. Buyer beware. (Story from Defiant)

Regulators are increasingly focused on the NFT market with the SEC now leaning in as they consider if some NFTs should be regulated as securities. (Story from Coindesk)

There is an increasing amount of talk these days about if the NFT craze has peaked and if the bubble is bursting (Story 1 / Story 2 from Fortune)

Brands + NFTs = Cultural Accelerant

As I referenced in the stories above, there is increasingly talk about the NFT price bubble bursting. I try not to talk too much about Crypto or NFT prices in this newsletter as I am much more interested in the Use Cases these technologies will enable. It’s for exactly that reason that I think a price correction could actually be a good thing for the market in long term.

None of what follows should be considered investment advice in any way.

When the media stops talking about prices, they can focus on the use cases.

People like to say that “we are still early”, but for most people who see endless articles talking about a Crypto Punk selling for $23+ million, or a Bored Ape selling for $3.4 million, it feels like they are actually late. These prices after all are not affordable for most people to buy into. And should they really? I mean how many PFP projects can really hold their value at these levels anyways.

“97-99% of NFT projects won’t pan out to be good investments during this early era” - Gary Vee

If people feel like they are too late to ride the price wave up to profit, then adoption requires an incentive other than money. In short, people need the category to be useful, fun, and easy - not just profitable. For this to happen, use cases need to be developed that people will see as relevant, attractive, and most importantly better and easier than alternatives. For those use cases and experiences to be worth the cost of development, there needs to be a sizable audience, and this means they need adoption.

This might sound like a vicious circle, but it’s not. We’ve been here before many times. In fact, the scale-up game is often all about predicting where consumers will be before they get there. This time, the game is just being played on much a larger scale.

So that gets us to the question of what are the Use Cases that we should expect, and how will they be delivered?

Up until now, the growth and the adoption of Cryptocurrency and blockchain technologies have been driven by and large by true technology Innovators, and tokenized investments and investors as Early Adopters (even NFT volumes are dominated by traders flipping NFTs as 80% of volume comes from 20% of the accounts). Lured by the promise of disproportionate financial returns, they are willing to endure the challenging KYC (Know Your Customer) hurdles, bad user experiences, and even the occasional “rug-pull” where they lost money with no recourse.

The above diagram illustrates the typical adoption curve associated with new technology. Based on global adoption rate data, that would put us firmly in the Early Adopter phase (with a few exceptional countries where currency risk is exceptionally high breaking out into the Early Majority).

In one of his famous Twitter threads, Chris Dixon states that Web2 was built on advertising. His tweet thread continues by stating that:

“Web3 takes a different approach by letting users and builders participate in the growth of networks as genuine owners. Instead of the value and control accruing to a company at the center, it gets distributed out to the edges, to the people who actually build the network. This means you no longer need advertising. Tokens are self-marketing. When someone genuinely owns something and feels skin in the game, they want to evangelize it.”

The challenge with this is that the self-marketing and evangelism largely exists in an echo chamber of existing users. We’ve seen this echo chamber effect loudly and clearly in the world of Web2 as people align themselves with friends and followers who reinforce their political views. I believe that getting past The Chasm that is typical at around the 16% adoption rate will require appealing to new audiences and creating new drivers and adoption incentives that are compelling to the Early Majority.

NFT’s have the potential to reach and onboard that new audience because they represent the potential for more than just profit, they represent a connection to culture. This point was made recently by Bankless Podcast host David Hoffman in a recent episode about Social Web3 (a great episode that’s very worth listening to if you haven’t already. The quote in question is at minute mark 54.17 - YouTube / Spotify).

“… as soon as the world gets this DeFi thing, Crypto is gonna take over. But it wasn’t DeFi (Decentralised Finance) that really brought Crypto to the world it was NFTs, and NFTs are a very cultural and very social use case. So I am wondering, is Crypto really going to come to dominate the world via the social use cases that it brings?”

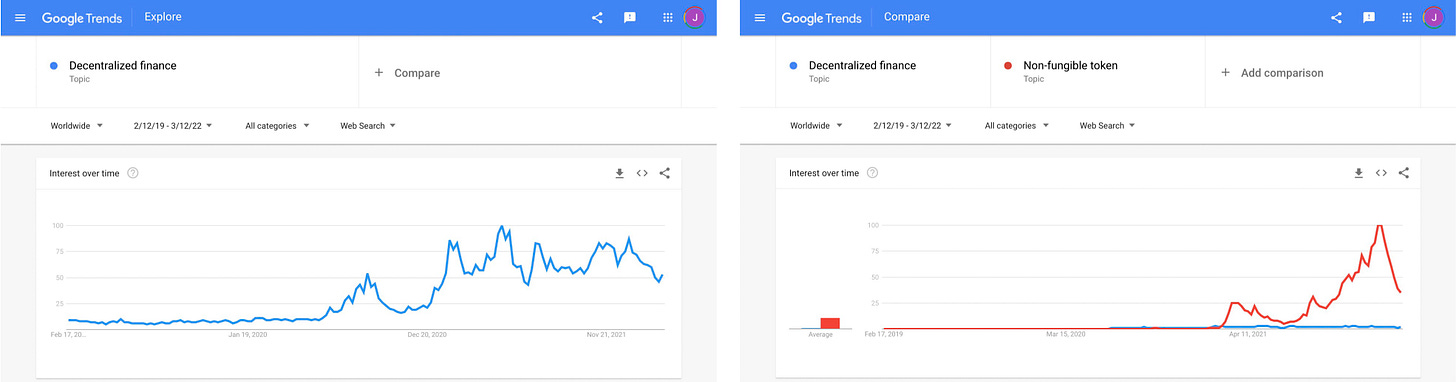

This cultural connection with NFTs is displayed even more clearly when you compare the growth in the number of people talking about and thinking about DeFi versus the number of people talking and thinking about NFTs.

But while that chart looks very impressive, it does not reflect the total number of people who actually own or use NFTs. Rather this is only a reflection of relative growth in the number of people thinking about and searching for information about NFTs.

Research from DappRadar tells us that adoption rate remains low with only 28.6 million wallets having transacted in NFTs globally. And within that small base, the distribution of ownership is has a diversity challenge with men being three times more likely to own than women. So while there is significant and growing interest in NFTs as cultural artifacts, their adoption remains relatively low versus the cultural attention they have captured.

Brands amplify culture & utility

It is in the nature of brands to reflect culture in the way that they promote themselves and connect with people. With this in mind, the growth of NFTs and Crypto as cultural artifacts presents an inescapable lure to the over $700 billion in annual brand marketing spend.

The above image illustrates the impact that brand marketing can have in amplifying the reach and adoption of messages, tools, and services.

While I agree with the point that Chris Dixon made in the tweet I quoted above that Web3 will not be built on advertising in the same way as Web2, it’s important to note that the power of marketing to amplify the reach of culture through stories, connections with people, and utilities that are genuinely useful extends beyond “advertising” in the traditional sense.

In this way, it is likely that brands will play a significant role in accelerating the reach and adoption of Web3, NFTs, Crypto, and the Metaverse. And we don’t have to look far to see how this is already happening.

Identity brands will lead the way

As people have entered the Web3 space, they have developed new ways to identify and distinguish themselves. Evolving from using names to pseudonyms, from profile pictures to verifiable NFT PFPs, or from choosing from a limited character set to developing a personal avatar. Each change is driven by a desire to communicate our unique values, passions, and individuality, and with change, new opportunities have been created for identity brands to step in and provide the assets that reflect how people might see themselves in the real world, or how they want to portray themselves in a virtual world.

Examples of this include:

Huge numbers of fashion, luxury, and fitness brands sell clothing for avatars across both gaming and metaverse environments. A few examples include: RTFKT / Nike selling NFT trainers and avatars, Louis Vuitton launched an NFT game, Ralph Lauren selling apparel for your avatar in Roblox, etc. Every day it seems that new examples come to market.

Vogue Business has released an NFT tracker within the fashion space. 🔒

Budweiser helped people to identify themselves with the music they love and prove their fan credentials by selling NFTs of tracks from emerging artists.

Snoop Dogg going a step further to help people associate themselves with the music they love by re-launching Death Row Records as an NFT music label.

Sports brands give people a way to get closer to their heroes by commemorating historical achievements (Under Armour), selling team tokens or player cards (NBA Top Shot, SoRare), or even giving people a way to build their favorite cars one NFT piece at a time (McLaren).

The most recent, and one of the ambitious examples was launched a few days ago by Gucci in partnership with 10KFT. The project has many components, and many unknowns remain, but they seem to have fully embraced the current NFT trend and long-standing luxury trend of exclusivity. In the case of this project, they have done it by putting a long list of requirements together to get a “mint pass”. With the promise of a “unique and personalized NFT envisioned by [Gucci creative director] Alessandro Michele and carefully crafted by Wagmi-san” there will be many people trying.

As part of the project, Gucci partner with many established NFT communities including 0N1 Force, Bored Ape Kennel Club, Bored Ape Yacht Club, Cool Cats, CrypToadz by GREMPLIN, Gutter Cat Gang, Mutant Ape Yacht Club, Pudgy Penguin,Forgotten Runes Wizards Cult, Wolf Game, and World of Women. If you own an NFT from one of these communities, you can also mint clothing items like the hoodies, backpack, jumper, and hat pictured above. Those items would be unique to the NFT that you own making it one of a kind. For now, these items are purely digital.

I’ve tried to keep this list short and just highlight a few of the different ways that brands are using NFTs to enable people to express their individuality and share their identity in the world of Web3.

What I expect to see going forwards is brands start to use AirDrops (which I wrote about in a previous newsletter here) to keep their NFT communities engaged with new content, products, and projects like the ones above. Image a fashion brand airdropping their community with NFTs of clothing from the next season’s IRL collection, or musicians airdropping remixes of popular tracks.

For these types of brands, AirDrops represent a possible evolution in loyalty and engagement mechanics and so expect to see a lot more there.

Partnerships that highlight shared values

Beyond Gucci whose partnership with different NFT communities helps them to deliver an authentic value add to the existing communities, there are also many examples of partnerships built on shared values:

The United Nations partnered with Boss Beauties in the launch of their Role Models collection to celebrate the most innovative women in history, as well as modern women who are breaking glass ceilings today.

Reese Witherspoon’s media brand Hello Sunshine, which is already famed for its focus on female-driven entertainment projects, partnered with World of Women in an effort to tell stories that celebrate inclusivity and equality.

TIME Magazine launches TIMEPieces NFT collection in partnership with 60 global artists in support of the humanitarian and relief efforts of Ukraine

Unlocking experiences, membership, and the power of community

There is so much that can be referenced here. Adidas partnership with Bored Ape Yacht Club to unlock the power of community. The huge number of concerts that we have seen sponsored by brands across Fortnite, Roblox, Oculus, etc. The Superbowl and many other sporting events augmenting the game (or in the case of the Superbowl) the halftime show with AR, virtual walk-through content, or even fully rendered stadiums in Decentraland or Sandbox.

But a few of the examples that still have my attention include:

Flyfish Club will open a Sushi Restaurant where only NFT holders will be able to make a booking. This approach of using NFTs to denote membership and belonging is now being replicated by a number of different categories including hotels, nightclubs, and even real estate.

The Australian Open combined a number of different strategies by opening their grounds in Decentraland and having treasure hunt style engagement in the space for POAPs and prizes, while also selling NFTs that were associated with prize-winning opportunities based on IRL match play,

Miller Lite also recently dove into the Metaverse by opening the Meta Lite Bar in Decentraland where people could pour themselves a virtual beer, play arcade games or darts or pool, talk with other people, play a tune from a jukebox, or even go to the bathroom.

While I might not personally love the idea of pouring virtual beers or of trying to replicate the activities you might do at a real-world bar in the Metaverse, I will say that I love the fact that Miller did this, and that they are taking some risk trying new things that they can learn from. I hope that their pioneering approach pays dividends as they go forward.

In my view, the thing to remember as we think about these experiences is that the virtual world and tokenized experiences should not be a substitute for the real world, but rather they should be an enhancement. The question is what do they do that either isn't possible in the real world or complements it in ways that were previously not possible or practical.

Based on the amount of investment in virtual real estate, it is a safe assumption that more and more brands will be looking to create experiences in virtual worlds. On that front, I believe the most successful ones will:

Focus on creating unique experiences: In the case of a bar, pouring a virtual beer might be challenging as it is unlikely to be as satisfying as the same action would be in the real world, but discovering new musicians, hearing live music - or live version of popular music would be a thought.

Make it about rewarding your audience and community with new services that are genuinely fun or useful: Thinking further about the bar and the music analogy, this might be done by creating a decentralized radio or jukebox where people get tokens to pick a song by scanning a code on a real-life bottle of beer and minting a token. In short, bridging the IRL experience of having a beer with the virtual experience of selecting the music. This could become a giant playlist from your consumers where people upvote the members with great taste in music or even donate their tokens to that person so they can play a longer set.

Bring communities together around shared values or missions: This is where real magic can happen and real opportunity exists. But it is also one place where there can be risk for the brand. Because as magic as conversations with people online can be, unmoderated conversations in a branded space can present challenges (Here is an article on the subject)

Utility services and functionality

While the above examples are focused on how brands can actively engage with consumers using the new paradigm and tools offered by Web3, there are also many examples of how brands will use the technologies to solve real-world problems or add base utility.

Aura is a blockchain service developed in partnership with LVMH, Prada Group, and Richemont designed to help prove the authenticity of luxury products and protect against counterfeiting.

There are many medical applications of both AR and VR, ranging from long-distance surgery to AR images of injuries, infections, or other bodily problems. Here is a recent link about a program the BBC just did on the subject.

Another favorite of mine is from Alfa Romeo who made the title of their new Tonale SUV an NFT. But this NFT offers more than just proof of ownership, it will record details of the car throughout its lifecycle, including all maintenance, as immutable records on the blockchain.

This last idea is really exciting as it is useful, but it also offers the automaker a new tool through which to engage with and add value to their owner community.

Connections with commerce

I have been through many scenarios of how brands are likely to accelerate the adoption of NFTs and Metaverse in the above, but brands, being commercial enterprises will need an accelerant themselves if they are going to take this path. One of those accelerants will be commerce. And in the commerce space, we are already seeing many new paradigms emerge.

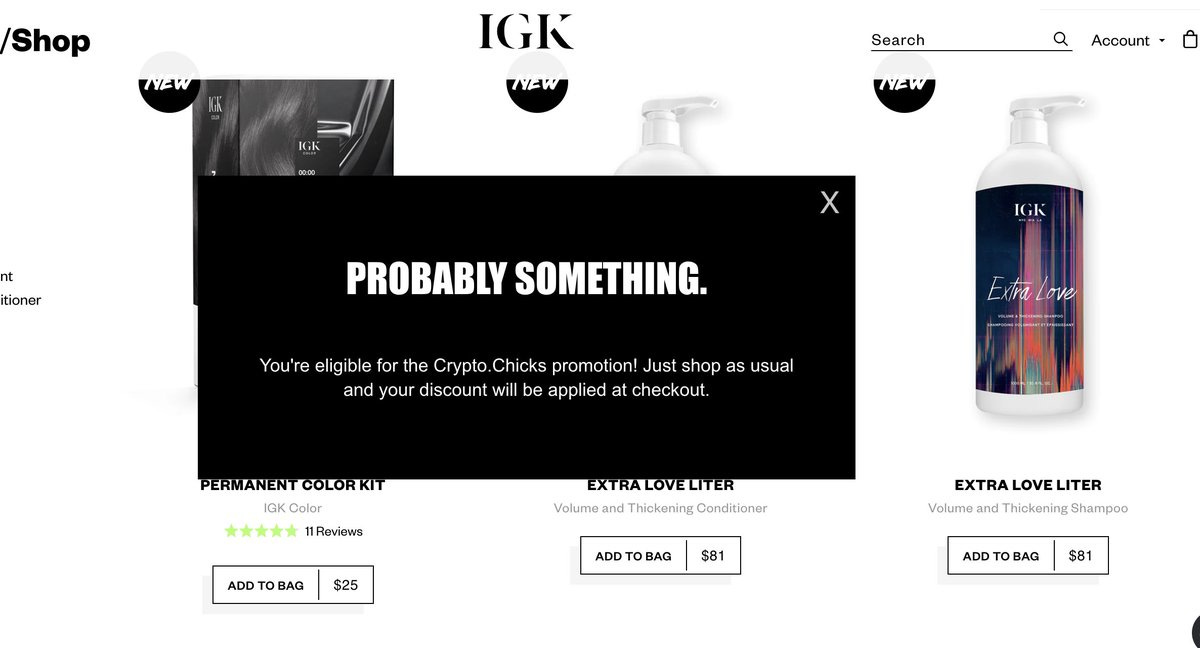

Brands are partnering with NFT communities to created gated commerce areas with exclusive products. Through a process called Token Gating, brands are able to restrict access to parts of their website allowing only the holders of specific NFTs to get in. In this same way, they can sell products that are exclusive to the owners of a specific NFT collection.

IGK Hair Care token gated some of their products by restricting availability exclusively to Crypto Chicks owners. What’s interesting here is beyond just offereing exclusive projects, they also offered exclusive discounts for these Crypto Chick NFT holders.

As the gating process grows in popularity, it will not only be large brands who will do it, but smaller brands will also take on this strategy as they want to offer something extra to specific NFT communities. In fact, this same strategy can be applied to loyalty benefits. Imagine a brand issuing their own loyalty NFT which when connected to their e-commerce platform gives token holders free shipping, or some seasonal benefits. The use cases are diverse, and they are getting easier to enable. In fact tools like the Manifold Merch Bridge make token gating easier, and more importantly, they make it possible on broadly used platforms like Shopify.

Beyond the token gated commerce landscape, we are also starting to see brands launching virtual world stores and sales models. There are already quite a few examples of this within the Fashion category, but beyond that, we have heard announcements from McDonald’s saying that they have registered Metaverse trademarks where they may open stores you can buy from virtually, but deliver to your IRL house. Another example that I am keeping my eye on and which is slated to open later this year is The Mall of Metaverse which is being put together by the team at MetaVRse.

Incentivizing influencers and advocates

One area where marketing strategies have continued to evolve and grow in recent years is in how they work with influencers. NFTs will offer a new dimension to this going forward, and will likely allow brands to engage with a broader number of advocates and through less formalized relationships.

NFTs as rewards for producing content or advocating a brand (when the content reaches certain predefined quality standards or reach metrics.

I mentioned the risk of unmoderated spaces earlier in this article. Image NFTs as incentives for people who help to moderate these ecosystems.

Or as Tech Support. You remember the Geek Squad from Best Buy. Well, brands could award online community experts who provide help and customer support with NFTs. This would not only serve to credentialize their expertise, but also to incentivize their continued support.

Other articles and podcasts that I have found interesting or useful

Santi Siri from Proof of Humanity on the Green Pill / Bankless Podcast

Metaverse fashion week is coming up in Decentraland. Starts on March 24th

(Not Metaverse focused) China pioneers a law to empower people over algorithms

As a closing thought, I want to ask a “what if” question

What if a big Web2 brand wanted to get into the Virtual Real Estate business? Would they apply the same paradigm as Sandbox and Decentraland and make the virtual world a finite and scarce resource? Or would they develop an infinite world? A pseudo-flat earth that would simply keep expanding in all directions as more people joined?

Imagine if you can a Go-To-Market strategy similar to how Google launched Gmail. It’s free for individual users, but to get access you have to be referred. In that way, Gmail was still scarce and desirable. Could the same be true for virtual land? A Metaverse where everyone can have a parcel of land to develop for free, but where businesses have to buy enterprise accounts/enterprise land parcels. In buying their land can choose different packages and locations with the ambition of capturing the traffic generated from the numerous free accounts/land parcels available to individuals.

The question is, does Virtual Land have to be scarce for it to have value?

Would this approach result in the creation of different world paradigms where Sandbox and Decentraland were more premium vs. free-to-get alternatives?

How would the platforms decommission or reclaim unused land to ensure there is a “density of cool” similar to what the Sandbox map exhibits with all the logos placed all around the map?

Is this a solution that would make virtual worlds feel more accessible to the audiences that can’t afford a four, five or six-figure prices for land?

What do you believe is required to create a vibrant Metaverse?

Please share your thoughts in the comments below. It’s a topic I’d love to discuss with you.

One last thing before you go, if you read this far and haven’t yet subscribed, you should. After all, how many newsletters do you read to the end?

And if you know anyone else who you believe would be interested, please share the newsletter with them. Thanks and have a great week.

Awesome insights. I do have some comments I would like to share

i dont think that land scarcity is the primary contributor of value. I think one of the biggest reasons open worlds like Decentralland or the Sandbox have high land valuations falls back to the strength of the team, the nature of the governance model & having a very strong community empowered to create & dictate how their mini-economies operate. Not to mention the great collaborations and events.

When you think about it, there isnt much scarcity when it comes to the availability of virtual land. Each project now claims to be working on a metaverse of their own, but eventually, peoples attention is going to flock to wheres value to be had.

We've seen how people are willing to sell a kidney to be neighbors with Snoop Dogg. They're betting that these exclusive new 3d websites are going to have the most foot traffic, with lesser grade virtual words existing but not enjoying that much attention.

with regards to reclaiming or decommissioning unused land, believe that streamlining the land rental process is going to be very beneficial for populating these worlds and realizing their full potential in the sense that land investors can lease out the land to developers thus unlocking some liquidity from their assets, and on the other side of the spectrum, the developers and brands have a low barrier to entry.

Personally, I advise brands on how they can enter this new internet and ideate on how to provide value to their users and raise brand awareness to a wider audience, the first question is, where are the people? :) (i usually take them on Decentraland tours)

Its a very valid question and platforms like Decentraland have about a couple of thousand daily active users, so to get to that stage of a vibrant, bustling world, i think that education and plus value are the key to more foot traffic. NFTs & blockchain games have proven that people are willing to re-skill & upskill knowing that there is some value to be had.

again, appreciate the insights and would love to connect some time T: @metaversive