Hello again. It’s been a few weeks, but thanks for joining me at Becoming Metaversal. In each issue, I aim to update you about what’s been happening in the world of Web3. My ambition is to help people and brands learn, grow, and build in the space. To achieve this, I have organized the content into two sections:

A longer format thought piece based on recent activities

News and links to great articles from other people you might be interested in

Lastly, if you are reading this and haven’t subscribed yet, you can join the growing group of people by subscribing here. 🚀

This is not the newsletter I wanted to write. When I launched Becoming Metaversal my ambition was to avoid talking about token prices because enough people already write already about prices going up, down, etc. My mission is to spotlight the promise that Web3 offers to people and business, as new use cases empower consumers, removes middlemen, transforms relationships, activate communities and brand purpose, and ultimately resets the digital value chain through the onboarding of the next billion users.

That said, after the collapse of $LUNA and $UST, and the subsequent price declines across the entire crypto ecosystem, price action is a topic that is impossible to avoid. There are thousands of stories of people who have lost their savings and their trust in this category, and while not discussed, there are also brands who had crypto reserves in both bitcoin and in stable coins, including $UST. Now some of the people and the brands that are feeling the pain have likely lost trust in their original plans to enter the Web3 space, and others are likely more hesitant to take their first steps.

To scale adoption it’s time for the industry to grow up and realize that Trustless Technology isn’t enough. Trusted behaviors are imperative.

Let’s start by explaining the concept of Trustlessness as it differs from Trust itself. Trustlessness is a reference to technology that removes the intermediary in a transaction and directly connects counter-parties. In this way there is no need to trust a middle man - the need for trust is removed, hence trustless.

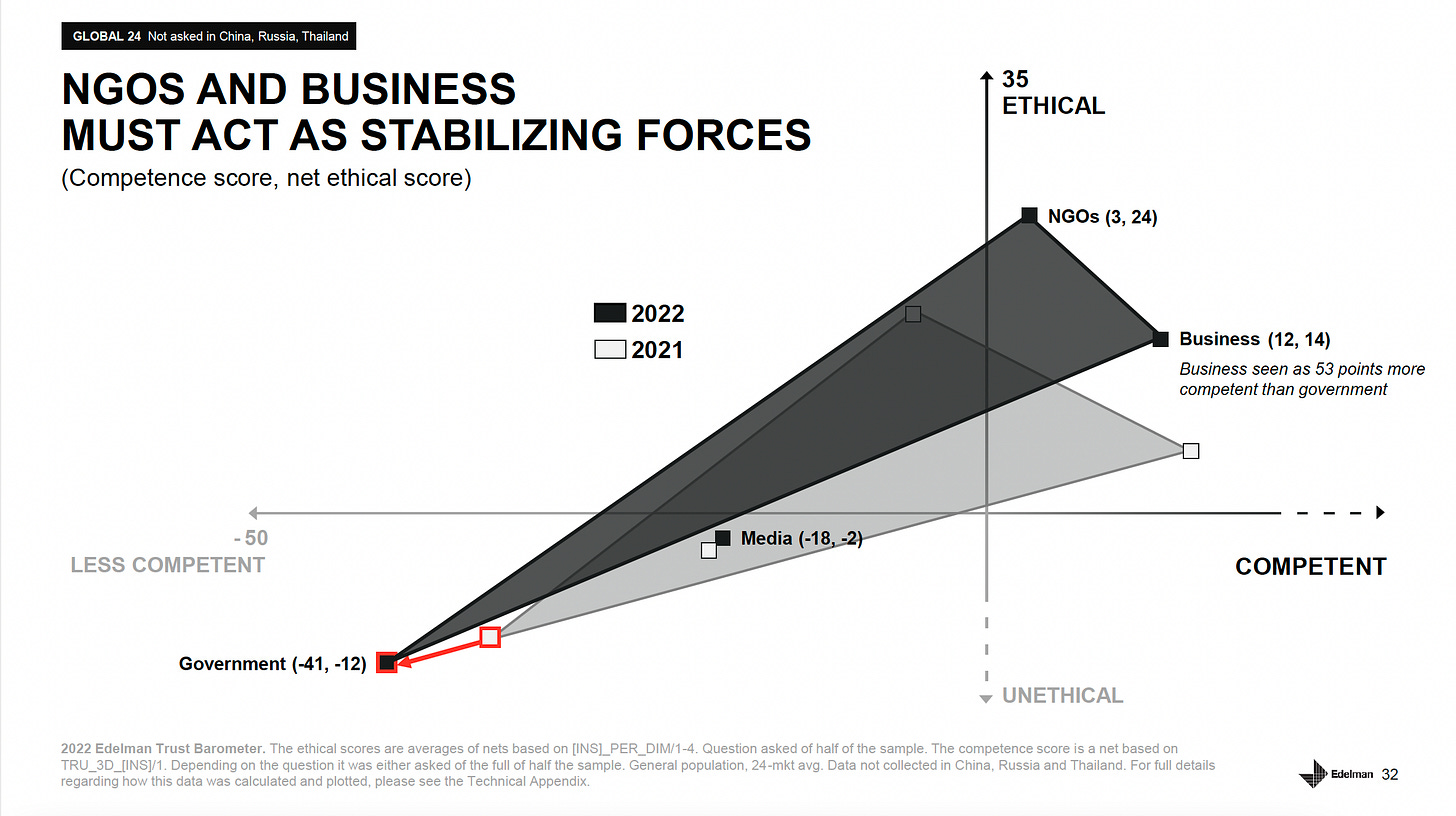

Trust on the other hand is fundamental to society and the traditional relationships that have existed between brands and people. That said, according to Edelman’s 2022 Trust Barometer, distrust has become society’s default state with 59% of people across 24 countries saying that their tendency is to distrust until trustworthy evidence is provided. Making matters worse, economic optimism is decreasing in the developed world with an increasing number of people believing that they will be worse off in 5 years than they are today.

In a world where people lack belief in the future, they search for alternatives, and in that search, cryptocurrency has increasingly been winning hearts and minds with 41% of people globally now saying that they trust Bitcoin over local currencies, according to a global Premise survey. This newly established trust is likely responsible for some of the explosive value growth that was seen in 2021 as the overall Crypto and NFT market caps went from $900 billion to $2.9 trillion and from $1 billion to over $40 billion respectively.

Today we have to ask ourselves, is the trust that people put into the Web3 and crypto category real, or has it simply been awarded based on a distrust of the status quo? Will that trust remain following the massive price declines of late? Whatever you believe the answers to these questions to be, one truth has always been clear:

Lasting trust is earned not given.

So if we want to continue to scale and accelerate the adoption of the category, the challenge is to increase earned trust through trusted actions every day. But looking at the Ponzi-like behavior, the rug pulls, and other money grabs, this isn’t what’s happening. Let’s just look at recent actions in the NFT space’:

Azuki price floor falls 68% when the found admit to having abandoned three previous projects.

The identity of the Azuki founder, who goes by the pseudonym Zagabond, is unknown. In NFT parlance when identities are unknown it is called being “undoxed” - being doxed on the other hand would mean your true identity is known to all.

You might think that a person’s unwillingness to share their identity would be a cause for alarm, and yet in the NFT world, being known exclusively by a pseudonym is not uncommon. The founders of Bored Ape Yacht Club for example remained undoxed until their identities were revealed without their consent.

And so, with it being fairly normalized, many people chose to trust Zagabond and the community he was building. They chose to invest in the Azuki NFT collection pushing prices up to over 30 ETH. But then, by necessity, Zagabond was forced to volunteer a confession about his past and to reveal the fact that he had previously launched and abandoned 3 NFT projects netting himself $3 million in the process while leaving the communities in limbo.

Naturally, trust faltered and prices collapsed. In response, Zagabond took to Twitter Spaces to defend his position where even more details came out:

He created new identities for every project

He pretended to be a woman for one project in order to garner greater investment

He did not allow any public questions or comments on his Twitter Spaces

Here is a good Twitter thread if you want the details on Azuki:

The point is simple. Just because anonymity is possible (and at times even prized) in this space doesn’t mean that people seeking investment should be trusted if they choose to remain anonymous. After all, people need ways to do due diligence.

Due diligence is even more important for brands needing to protect the value and trust they have created over years of engagement. This fact didn’t stop Gucci for example from partnering with Azuki on their 10ktf NFT project, and while I don’t believe there was any brand damage done to Gucci as a result of this, I doubt many brands will be looking to partner with Azuki or other Undoxed teams in the near term.

LESSON 1: TRANSPARENCY MATTERS.

Transparent identity and reputation are vital to establishing the trust needed to drive the consumer investment and brand partnerships that are vital to teh continued growth of the category.

NFT artists and marketplaces accused of using inside information for personal profit

Takashi Murakami, who created the highly sought-after CloneX collection for RTFKT and is one of the most prominent NFT artists in the world, was accused of snipping rare NFTs from his own collection before the Metadata was revealed to the owners. The metadata associated with each of the NFTs is what allows people to know the rarity of their NFTs and hence vital to understanding the value of your asset.

If acting on inside information before it is made public sounds similar to insider trading to you, well that’s because it is similar. That said doing this is not illegal. NFTs are not securities and hence those laws don’t apply, but ethically the idea is quite similar. And the mere question of ethical impropriety likely had an impact on the price of the NFTs as they declined from over 6 ETH to under 4 ETH shortly after launch.

It is important to note that the accusations were NEVER proven to be true, and given Murakami’s prominence in the space, I personally doubt that there is any validity to the accusations. That said, a former exec from the NFT marketplace OpenSea was recently charged with insider trading following private NFT purchases made based on knowledge of how they would be promoted on the marketplace.

The stories are different, but together, the accusations put focus on the fact that there has been very little to prevent people from acting unethically in this space - at least up until now.

LESSON 2: ACT ETHICALLY.

This is only one example of how the ecosystem can be abused and can create failure in the court of public opinion - and trusted public opinion is the neccessity if our ambition is to continue to onboard new users to scale this industry.

Bored Ape Yacht Club shows a lack of empathy after their highly anticipated but poorly executed Otherdeed NFT mint

The recent Otherdeed NFT mint from Yuga Labs (creators of Bored Ape Yacht Club) was anything but smooth. As arguably the most anticipated NFT drop ever there was fervent demand, but in hindsight, it seems that despite all their financing, and despite all the efforts to KYC participating crypto wallets, the Yuga Labs team appeared ill-prepared.

Gas fees exploded - Gas fees soared to prices rarely seen, ultimately reaching an average transaction cost of nearly $3,000 with some transactions prices getting up to 4.6 ETH ($12k USD)

Many transactions failed - Because gas fees are charged for using the Ethereum network even if a transaction isn’t completed, many people wound up paying those high fees despite having failed transactions. In short, they paid the fee but didn’t get the NFT they were trying to buy. And because of the demand and congestion on the network, this happened a lot. It should be said that in this regard, Yuga Labs did the right thing and refunded all of the fees that were lost due to failed transactions.

Ape Coin collapsed - Forcing people to pay for their Otherdeed NFT using Ape Coin created an artificial demand for the currency as everyone rushed in preparation for the NFT launch. Immediately after the launch, the demand disappeared and prices collapsed. As an investor, these are the risks you take, but for those people who didn’t really want to own Ape Coin, but just wanted to buy the Otherdeed NFT, if their transaction failed, then there is a good chance they wound up stuck with a depreciating asset they never wanted in the first place.

Yuga Labs acknowledged that problems occurred, and as mentioned above, they repaid the transaction fees associated with failed transactions. But they failed to acknowledge their own accountability for the problems and instead deflected by blaming the Ethereum Network.

Immediately after this mint, prices of all Bored Ape / Mutant Ape / and Kennel Club NFTs from Yuga started to fall. We have since moved into an NFT and a Crypto bear market so it’s hard to say how much of that the price fall was due to the errors and challenges associated with the Otherdeed mint, but at the same time, it’s hard to ignore.

LESSON 3: BE ACCOUNTABLE.

We all make mistakes. In is especially easy to make mistakes when operating in the fast changing Web3 ecosystem. But when your mistakes impact someone else, empathy and acknowledgement are critical to maintaining the trust needed to scale over time.

Included in the above examples are some of the most notable, successful, and respected NFT collections, and yet in each case, community trust has been challenged in ways that would not be tolerated by traditional businesses. And these examples are definitely not the worst offenders and violators of consumer trust. That category belongs to the rug-pullers, fraudsters, and IP thieves out there.

Iconics — $140,000 rug pull project based on the Solana blockchain was supposed to deliver 8,000 randomized 3D artworks to investors, but instead just left people with random collections of emojis.

Frosties NFT — Following their $1.3 million rug pull, the operators of the Frosties NFT rug pull were arrested.

Evolved Apes — After launching, the founder of this project pulled $2.7 million worth of ETH that had been designated for the development of the project road.

Pixelmon - While not a rug pull in the same sense as the above, Pixelmon raised over $70 million for the development of a game only to deliver NFTs with terrible art which was discovered to have been created

Discord Scams - Every week it seems there is another report of theft through Discord hacks. Its become impossible to allow Direct Messaging or to click on any links in discord because of the abundance of scams and people trying to get your wallet details.

Google Scams - It’s not just NFT collections where problems exist. The below image shows how fraudsters created a fake marketplace, using a near-identical URL to the real marketplace, and then advertised in search.

As a final example, I want to point out the recent Not Okay Bears project that launched despite it being blatant IP theft from the Okay Bears collection.

For background, Okay Bears is an NFT collection that launched on the Solana chain and immediately gained a large following and drove high sales volumes. In response, a team quickly launched Not Okay Bears on the Ethereum network as an obviously plagiarized version. Despite the obvious plagiarism, the collection still grew very quickly gaining over 3.5k ETH in sales on OpenSea before being delisted.

At this point, the buyers of the Not Okay Bears NFTs are left owning them, but without a marketplace where they can sell them. Was it their fault for buying them in the first place? Is it a problem that OpenSea allowed these to be traded in the first place? These are all valid questions, and whatever the answer, the reality is that the buyers of these NFTs still have them in their wallets, but have effectively lost their investment as they can’t be resold. This behavior has challenged even the most ardent of NFT collectors.

LESSON 4: RESPECT IP.

We are seeing a trend in the NFT space towards CC0, a creative commons copyright that allows people to use published works in new ways without needing to pay royalties. That said, most projects still have some copyright protection, so do your homework and respect it. And even if the IP is open, refer to lesson two and ACT ETHICALLY. Don’t just try for a cash grab.

Despite all that I have said above, the NFT and Crypto markets move so fast that people often say “everyone will forget everything by tomorrow if the market moves back up”. And they might be right. In fact, given the bear market, it might not even require an up move as many of the above-mentioned issues, while only a few weeks old, are probably already forgotten by the community. But as the audience grows beyond Degens, violations of trust won’t be forgiven so easily.

Incorporating the lessons

The above examples represent some of the most notable, successful, and respected NFT collections, and yet in each case trust has been challenged in ways that would not be tolerated by traditional businesses.

That said, what gives me confidence that NFT collections are moving in a positive direction from a Trust POV is the move beyond a pure rarity focus and towards utility. I say this because utility/usefulness/experience are how long-term consumer trust is typically built and maintained as noted by another trust study from Edelman which states that 87% of the consumers cited their experience with a product as a reason for trusting a brand and that 73% gave the quality of the product or service as the reason for their trust.

And there are some reputable collections such as Moonbirds (led by Kevin Rose), Crypto Packaged Goods (led by Chris Cantino and Jamie Schmidt), and BAYC that are leading the way towards utility. Having established strong, active, and trusted communities, these collections are innovating around service and value models. One of my personal favorite examples of a web3 business innovating around utility is The Fabricant - a dutch metaverse fashion and NFT brand that is upending the design model and allowing anyone to be a designer.

It a new way of looking at co-creation that is simple in how it aligns incentives. Garments, materials, and styles are created separately but made available to creators such that they can mix, match, personalize and ultimately sell the designs and styles of their own. The revenue from sales is then distributed to all parties who contributed elements to the final design as follows:

Garment designer - 30%

Material designer - 30%

Co-creator - 30%

The Fabricant Studio - 10%

In short, they aren’t just creating an NFT collection that aims to capture value by selling rarity and FOMO, but they are building new utility into a traditional market that empowers the growing community of creators in the world.

The shift in focus from rarity to utility is an open door for brands to step through as trusted partners, but to date, few have walked through it.

At the top of this article, I noted that distrust was the norm, and that crypto had become a safe haven as people sought out alternatives to the Status Quo. But as crypto prices wane, it’s unlikely to maintain the same trust levels.

Looking at societal trust on a broader level than just Web3 (as seen in the chart above), it’s clear that brands (and NGOs) are seen as trusted leaders not just for products, but also for social issues. The reason for this is two-fold:

Brands have earned the trust of their consumers through consistency of behavior over years.

Brands are aligning their values to the value of culture, and are increasingly enabling new social behaviors through product innovations.

Many amazing brands are already thinking about innovating with Web3 to develop new business models, partnerships, and products. In short delivering utility. Some examples include:

The Financial Service industry is rapidly adopting crypto. One notable example is how Stripe is now enabling USDC payment via Polygon.

In the automotive industry, Alfa Romeo has created an NFT car title that doesn’t just signal ownership but also appends maintenance records to the NFT to increase trust

LVMH, Cartier, and Prada partnered on the Aura blockchain to help increase trust about both supply chain and authenticity

These are great use cases to leverage the web3 technologies, but they are still not capitalizing on the community strength that we see in NFT communities. Brands like Time for example are working to build both community strength and utility in ways that have the potential to leverage established models of developing brand trust, with new go-to-community strategies simultaneously. In this way, NFTs can become the bridge that connects trustless technologies and emerging web3 business and community models, with established strategies for brand building through trusted behaviors, product reliability, and loyalty incentives.

Established marketing models for developing trust will not disappear or become irrelevant just because a new “trustless” technology comes along. Despite the media’s love for clickbait and their constant need to say that one thing is killing or replacing another, it is rarely so simple.

There is still a long road ahead before we see true mass consumer adoption of web3 technologies. Fuelling its continued growth requires more than simply converting established brands over to new technologies - it requires web3 brands to demonstrate the types of trusted behaviors that have proven valuable to growing brand trust (and business) throughout history.

I’ll wrap up this newsletter with a quote from noted crypto skeptic Warren Buffet:

Transparency, accountability, ethical behaviors, and respect for IP are needed if we are to successfully scale beyond Degens and earn the trust of people everywhere.

If you enjoyed reading that, why not give it a share. It doesn't hurt, but definitely helps broaden the reach of what I hope is a newsletter with a different approach to the category.

News, articles, podcasts, and resources that got me thinking

There are a bunch of events coming up. Seems like there always are. But if you are going to be there. I am sure that MET AMS, NFT.NYC, and The Cannes Festival of Creativity will all be amazing. And if you will be in Cannes, let me know, I would love to say hello IRL.

Apple is having their WWDC, and it’s rumored that there will be a few Metaverse-related announcements - including new announcements about content for Digital environments. That said, it’s unlikely that their VR / AR headset will be launching this year according to this article from the NYT.

Lens Protocol launched the ability to claim individual handles, and also launched the developer garden where you can see how people are building with this new protocol.

I talk to a lot of brands about Metaverse, NFTs, and Web3 overall. The part that gets everyone most excited is when we can have an honest conversation about the challenges that exist with the technologies today, the challenges that exist with Web2 technologies today, and the potential to lean into Web3 to make it a technology for good. For those of you interested in that subject, Li Jin's recently published newsletter, and Harvard Business Review article is a must-read.

An absolutely fantastic thread on IP law, and how this should be considered and thought about in relation to the Web3 and NFT space.

A great article about the problems with anonymity. Looks at some of the same issues that I mention in this article.

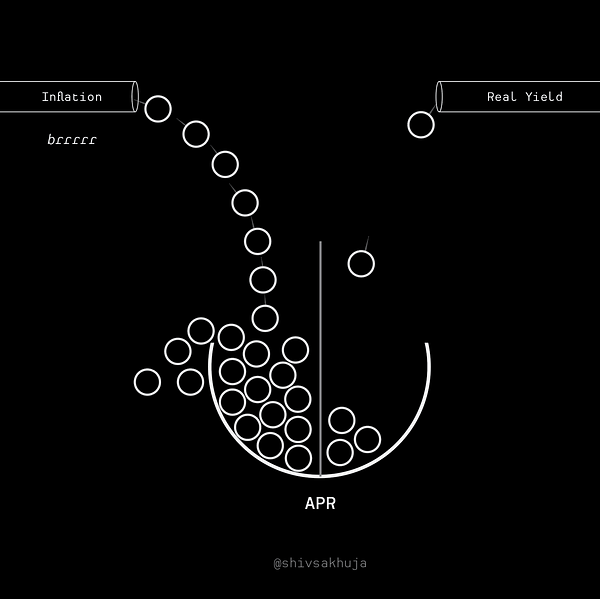

Where does all the money come from in DeFi? How do they pay such great interest rates? Have you ever wondered? Have a read of this great thread.

The always great newsletter from Packy McCormick is particularly great this week as he thinks about token economies.

And lastly, if you are in the market for a new place in NY and have 15,000 ETH to spare, it’s happening. Property for sale on OpenSea as an NFT.

Obviously nothing contained in this newsletter should be considered financial advice.

One last thing before you go. If you read this far and haven’t yet subscribed, you should. After all, how many newsletters do you read to the end?

And if you know anyone else who you believe would be interested, please share the newsletter with them. Thanks and have a great week.

Not sure how you got the idea for this piece, but interesting exploration of why some form of trust is still required in blockchains, and why it’s not necessarily a bad thing.

Reputation obviously matters, and it’s good that the blockchain is transparent enough for us to be able to fish out bad actors.

Great piece!