Hello everyone – and thank you for reading this edition of the Becoming Metaversal Newsletter. I can’t begin to tell you how much all of your comments, shares, likes are appreciated. That said, this is only on Newsletter number 6, so I’m still trying on to grow the subscriber base. If you find value in what I have to say, please do share. It means more than I can express when you do.

Now onto a few short stories about what’s been happening over the past couple of weeks, and then onto a longer story about AirDrops and what they could mean for people, brands, businesses, and start-ups.

Keeping up to date with the Web3

Here are a few of the stories making headlines in the past few weeks that we should be thinking about:

Large-scale events continue their push into NFTs with both the Superbowl and Coachella announcing plans to incorporate NFTs as memorabilia, collectibles, or even lifetime passes to future events.

Pushing beyond NFTs and into the Metaverse, the Brooklyn Nets introduce the 'Netaverse' which is the first virtual reality broadcast of live game action.

Following on from the MetaBirkin trademark infringement lawsuit, and the Stormtrooper Art Wars NFT scandal, the IP space remains a challenging area to navigate.

This week we saw Nike sue StockX for Trademark Infringement following their launch of Vault NFTs.

Furthering this IP debate, the RIAA is threatening legal action against the new music NFT platform HitPiece alleging infringement of their IP.

Abuse and harassment aren’t just issues in the real world, but present real threats in the Metaverse. To address this, Meta is launching a ‘personal boundary’ to VR avatars to protect people and prevent harassment in their ecosystems.

Solana introduces Solana Pay as a new tool allowing merchants to accept digital currency such as stable coin $USDC for a fraction of a penny with no intermediary. But the real potential goes beyond reduced fees, as the next phase of the platform’s development promises a direct connection between the merchant and the consumer where the merchant can send digital assets back to the consumer, thereby opening up new potential avenues for loyalty, promotions, etc.

Celebrities continue to launch, endorse, and shill different crypto projects. A few of the biggest recent announcements include:

Lebron James partners with Crypto.com to teach kids about blockchain

Justin Bieber buys himself a Bored Ape

Shaquile O’Neil launch NFT collection for charity

John Legent launches for Artists and Musicians called Our Song

Paris Hilton invests in NFT platform Origyn

Yuga Labs, the business behind the Bored Ape Yacht Club, has raised $200 million at a $5 billion valuation from Andreessen Horowitz making it a true powerhouse brand in its own right.

RTFKT airdropped a new mystery NFT to all CloneX NFT holders. It’s the first drop to include the Nike logo since they were called. It’s called MNLTH and for now, no one knows what it will do or become.

This seems like a good place to transition into a longer story.

AIRDROPS

What are they – and more specifically, what is their potential to influence brand marketing and loyalty practices. Some of you will already know what AirDrops are. In fact, many of you may have received an airdrop, but for those of you that who haven’t and don’t know what they are …

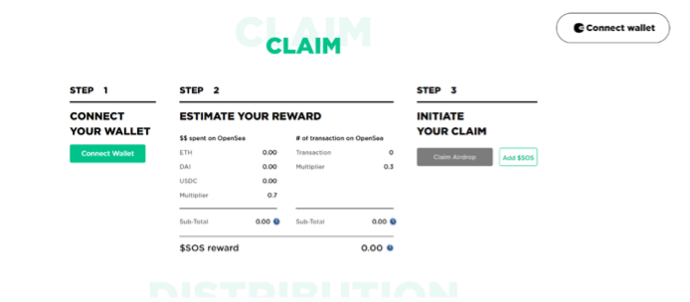

… an AirDrop is the process of distributing crypto tokens (typically for free) to specific crypto wallet addresses. The tokens can be automatically deposited into your wallet, or a system can be put in place by which a wallet owner must claim their AirDrop’d tokens. In the case of the latter, a system is built to validate that the wallet is entitled to the Tokens. This entitlement is typically based on past transaction history (which can all be checked as part of the public blockchain).

Before getting into a description of what this could mean for marketing, let’s look at LooksRare as a recent example of how an Airdrop can work.

You may not have heard of LooksRare as they are still a fairly new platform, but in summary:

LooksRare is an NFT platform that competes with industry leader OpenSea, as well as other NFT platforms such as Nifty’s, NiftyGateway,

They launched on January 10th of this year

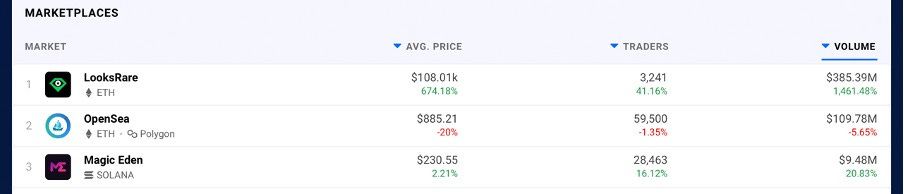

On their first day, LooksRare sold $385m worth of NFTs, which was double the total transaction value of the market leader OpenSea on that day

The average number of traders on LooksRare today sits just above 2,500 people. While this is but a fraction of the 50,000 person daily average of OpenSea, their launch and immediate success at driving both transaction volumes and values are impressive. Especially so when you think that as a one-month-old business they gained and retained 5% market share.

Key to their early success has been the fact that they launched with a token called $LOOKS that they airdropped to existing OpenSea users.

In doing this, they built-up a base of potentially high value, and highly active NFT trading customers by airdropping their token to every crypto wallet that had transacted over 3 ETH worth of trades on OpenSea between the 16th Jun 2021 to 16th Dec 2021. The total volume of $LOOKS tokens that an individual was eligible to receive was ratioed based on the volume and value of the transactions that they had performed on OpenSea during the eligibility period. Because OpenSea transactions occur on a public blockchain, the exact details of which wallets transacted with OpenSea can be easily identified or validated.

LooksRare was not the first to airdrop tokens to a competitor’s customers. The process is actually common enough in the Crypto world that it has a name: it is called a Vampire Attack because it is designed to suck customers from one platform to another by providing a tokenized incentive. In fact, OpenSea had been the target of another Vampire Attack earlier in the month of January when OpenDAO airdropped their $SOS token to OpenSea users. For highly active OpenSea traders, the token values of these AirDrops amounted to thousands if not tens of thousands of dollars in value – but that is not the point of this story, so let’s move on.

In both the case of $LOOKS, and of $SOS eligible wallets had to claim their airdrop. This means they had to go to a website and input their wallet address to receive their token allocation. This claim process is increasingly seen as best practice, but it is equally possible to simply deposit tokens into someone’s wallet without any prior consent - but in so doing, the depositor would need to pay the associated “Gas fees” (the fee required to conduct a transaction). The claim process puts the burden of paying Gas fees on the recipient.

THE FUTURE POTENTIAL FOR AIRDROPS

Let’s start by admitting that most brands won’t be able to AirDrop tokens of significant value as not everything can be collectible or exclusive or rare. That said, the precision of targeting people based on blockchain engagement will be too valuable an opportunity for brands to ignore. To better understand how it could potentially work, let’s take consider an imaginary future Use Case involving a luxury car brand.

For purposes of the article, let’s suppose the car brand is already using NFTs to replace car titles (I believe this is likely to happen as it will allow the manufacturers to append verifiable maintenance records to the NFT and could also be used to incentivize owners to use their after-market and maintenance services instead of a 3rd party) meaning that there is an association between the car brand and the owners crypto wallet.

OPPORTUNITIES

Immediately this creates a number of opportunities for the brand to reward their own customers by dropping tokens / NFTs into owner wallets based on telemetry data about how the driver uses the car, where they go, etc

Obviously, this could involve providing maintenance notifications, but that is already easy to do through an App (and potentially better done through an App)

In cases where the driver has a car subscription, Airdrops could be used as a way to upsell the driver on premium packages. For example, airdrop them keys (in the form of an NFT) to a new car parked near their house. If they use the NFT then they have automatically subscribed to a more premium package, if they don’t use it, the smart contract expires and the key is no longer accessible.

Perhaps a more interesting opportunity would be to use airdrops within their partner ecosystem. In this way, partners would be able to combine deterministic data points from the driver’s Crypto Wallet to deliver airdrops that offer enhanced value to what is possible today.

Imagine a partnership with a Credit Card company where rewards are offered to people who take long road trips. As the car leaves its typical circumference, telemetry data from the car brand signals the credit card company to airdrop tokenized incentives or travel rewards.

Or a partnership with Tock or another restaurant reservation platform where they airdrop offers hard-to-get reservations to the luxury car owner. (This may not sound like what you’d imagine a token to be, but given that a token is nothing more than a smart contract, there is no reason why it couldn’t be an offer for an exclusive experience or reservation).

If you’re thinking that these types of partnerships would be possible in a Web2 world as well, you’re not entirely wrong. But while they might be possible, they wouldn’t be practical due to cost and limitations in the pricing models. Unlike typical partner programs today that are priced based on the size of the audience and assumed usage rates, in a Web3 world, these partnerships could be priced based on exact usage and value parameters.

In short, because the partner rewards would exist as smart contracts, they could be priced in ways that resemble affiliate marketing programs today - where payment is made based on conversion (and in real-time). Equally, if we assume that in a Web3 world, Crypto Wallets will have a broad range of identity data, then we would also likely see unexpected lateral partnerships between brands where the relationships are too small in a web2 world, but could potentiall be made profitable for all parties through smart-contract pricing and payment.

COMPETITORS

All that said, airdrops into an open wallet would also allow competitive automotive brands to target your customers with airdrops precisely thereby conducting Vampire Attacks of their own. If for example, luxury car brand Gamma wanted to offer test drives to owners of luxury car brand Omega, they could not only identify the owners, but they would also be able to see the date the Token indicative of a Title was created in their wallet. With this data, they could reliably estimate when the person is likely to be in the market for a new car.

One likely solution to this will be the use of Private Chains for high-value products and ownership titles. Private chains will allow for all the functions of Smart Contract functionality, but without allowing visibility into the contract (additionally, it is likely that these chains will be fairly centralized in comparison to public blockchains).

SPAM

One other concern to consider is SPAM.

Today, in your email inbox you probably get quite a bit of what you would consider to be SPAM. You probably have a SPAM filter, but that probably doesn’t get all of it. It’s a growing problem, but really all in all it only amounts to a small burden to each of us.

This is not necessarily the case when it comes to AirDrop SPAM. Tokens, being Code at their core are just small programmed Smart-Contracts can contain almost anything, from crypto-currency tokens and NFT imagery, to brand promotional, to viruses and trojan horses designed to infect and compromise your computer or your wallet.

The practice of AirDrop SPAM hasn’t been a huge problem up until now for two reasons: firstly that you need to get the person’s wallet address, and secondly that there are Gas fees associated with AirDroping tokens directly into someone’s wallet. That said, as Web3 continues to scale, and as more people publicize their ENS addresses, this challenge is likely to continue to grow.

Good thing there are already businesses working on the problem, but that is for another day.

Thank you again for taking the time to read this Newsletter. I continue to work on the format and content structure, so please do comment and let me know what you like, what you don’t like, or just ask questions and I will always do my best to respond.

Beyond that, if you find the content interesting or valuable, please share it. It’s the best way to show your appreciation.

If you haven’t subscribed, please do. It might be free, but subscriptions are what tell me that people are listening.

Hey Justin - loved reading this - many thanks for taking the time to write these super informative posts. I have a question mainly coming from a position of ignorance - while you outline how useful to brands NFTs could be to provide greater control over the brand-customer/user relationship are there many signs that consumers are as enthusiastic? And if so are we currently talking about a pretty fervent bunch of early adopters (the LooksRare stats maybe?) but signs are that this will become a more universal way of doing things?

So far, the Netiverse is just a better way of letting them show you the game. Next up is giving every viewer personal control of their viewpoint. So, for example, you could zoom in and automatically track a given player. Your view on one screen, theirs on another. Nothing more than video game technology with a live feed.

As for airdrops, it seems to me that your luxury brand car company would have a strong incentive to provide a private blockchain in order to insulate their customers from competitive attacks. Or would the user be able to control who can access what parts of their personal data?